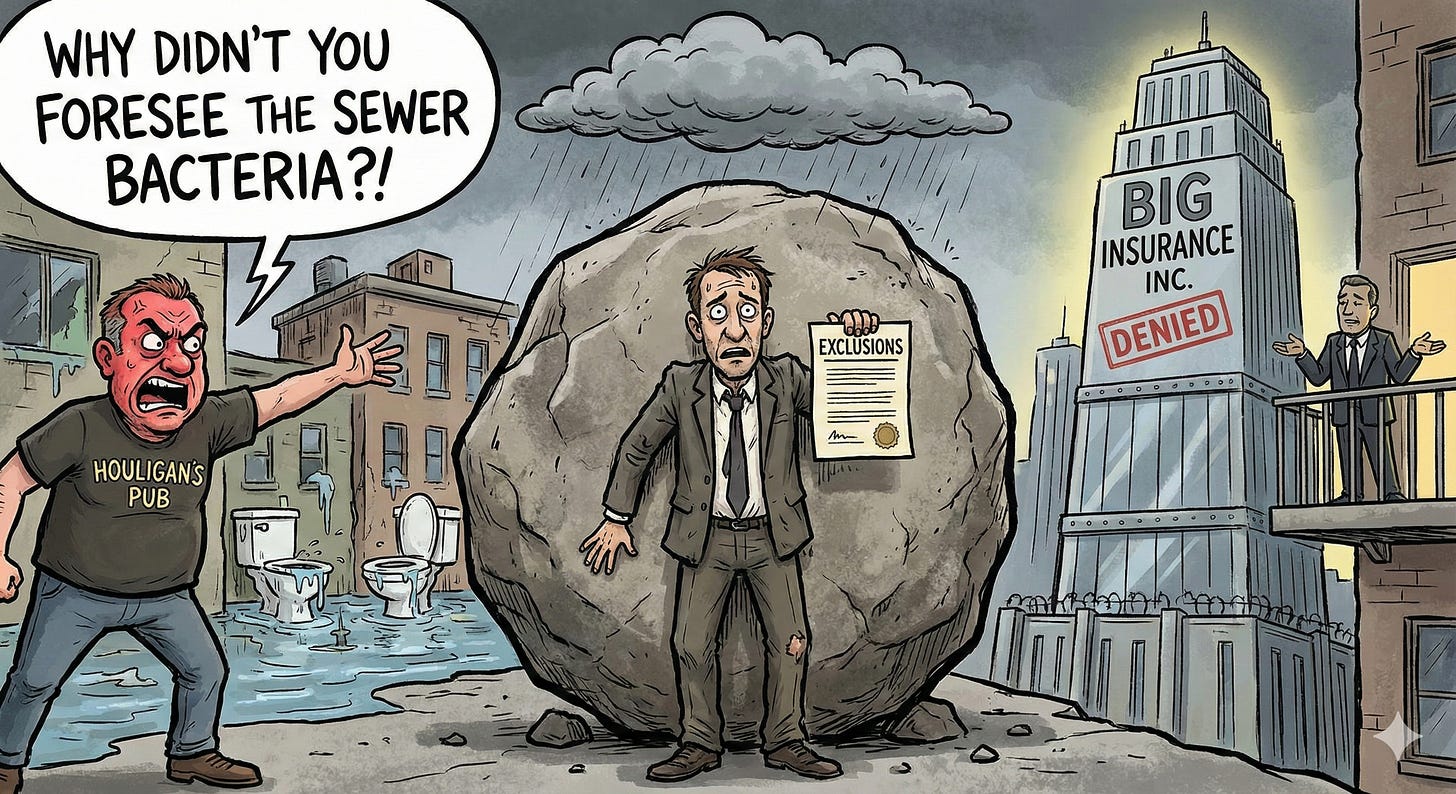

The Crystal Ball Defense:

Why Agents Can't Be Your Savior

Florida courts finally said the quiet part out loud:

insurance agents are not magicians.

A recent ruling involving Brown & Brown shut down a dangerous precedent where a jury tried to pin a broker with a $1 million loss because a pub’s toilets backed up during Hurricane Matthew.

The argument?

That the agent should have “known” the business needed coverage for sewer-borne bacteria.

Here’s the problem:

That coverage wasn’t available at the time.

The court did what courts rarely do anymore; it applied common sense. It ruled that an agent’s job is to procure insurance, not to act as an all-seeing risk oracle for business owners who don’t read what they sign.

Thirty Years in the Trenches Taught Me This

I spent 30 years inside this system. Not theorizing. Not armchair quarterbacking. Living it.

Here’s the trap agents live in:

If agents recommend every conceivable “what-if,” clients scream about overpriced, useless coverage.

If they don’t predict a once-in-a-generation scenario involving microscopic bacteria during a hurricane, we get sued.

Meanwhile, carriers crank out exclusions faster than any human can explain them, and then pretend the agent controls the pen.

Agents are wedged between a rock and a hard place:

Expected to be clairvoyant protectors of the public, while being handcuffed by carriers who design policies to transfer risk back to the policyholder quietly.

This Ruling Matters More Than You Think

This decision is a rare win for sanity.

It reinforces a simple truth:

An agent is not an unlimited guarantor for everything that can possibly go wrong.

If coverage didn’t exist, you can’t sue a broker for not selling it.

If you didn’t read your policy, you don’t get to retroactively rewrite it through litigation.

And no — an agent’s E&O policy is not a consolation prize for buyer’s remorse.

They sell policies.

Not miracles.

Why INSSUX Exists

This case isn’t about protecting agents.

It’s about exposing how broken the system really is.

Policyholders are confused.

Agents are scapegoated.

Carriers hide behind language.

And everyone pretends this is normal.

INSSUX exists to call that bluff; calmly, clearly, and relentlessly.

The INSSUX Rip-Off Detector

The Rip-Off Detector is our first step.

It’s designed to take your policy and show you, in plain English:

What’s actually covered

What’s quietly excluded

Where limitations and sub-limits hide

And which clauses should raise red flags before you rely on them

No legalese.

No scare tactics.

No pretending every loss is a conspiracy.

Just clarity.

Behind the scenes, we’re training advanced models to recognize the same patterns insurers and attorneys look for — not to replace professionals, but to level the information gap that leaves policyholders guessing and agents blamed.

Because once you can see the exclusions, the game changes.

See the Rip-Off Detector at inssux.com

🔥 Join the Resistance

We expose the nonsense. We translate the fine print. We give people leverage instead of fairy tales.

👉 Join the INSSUX Rebels on Telegram: t.me/InssuxRebels