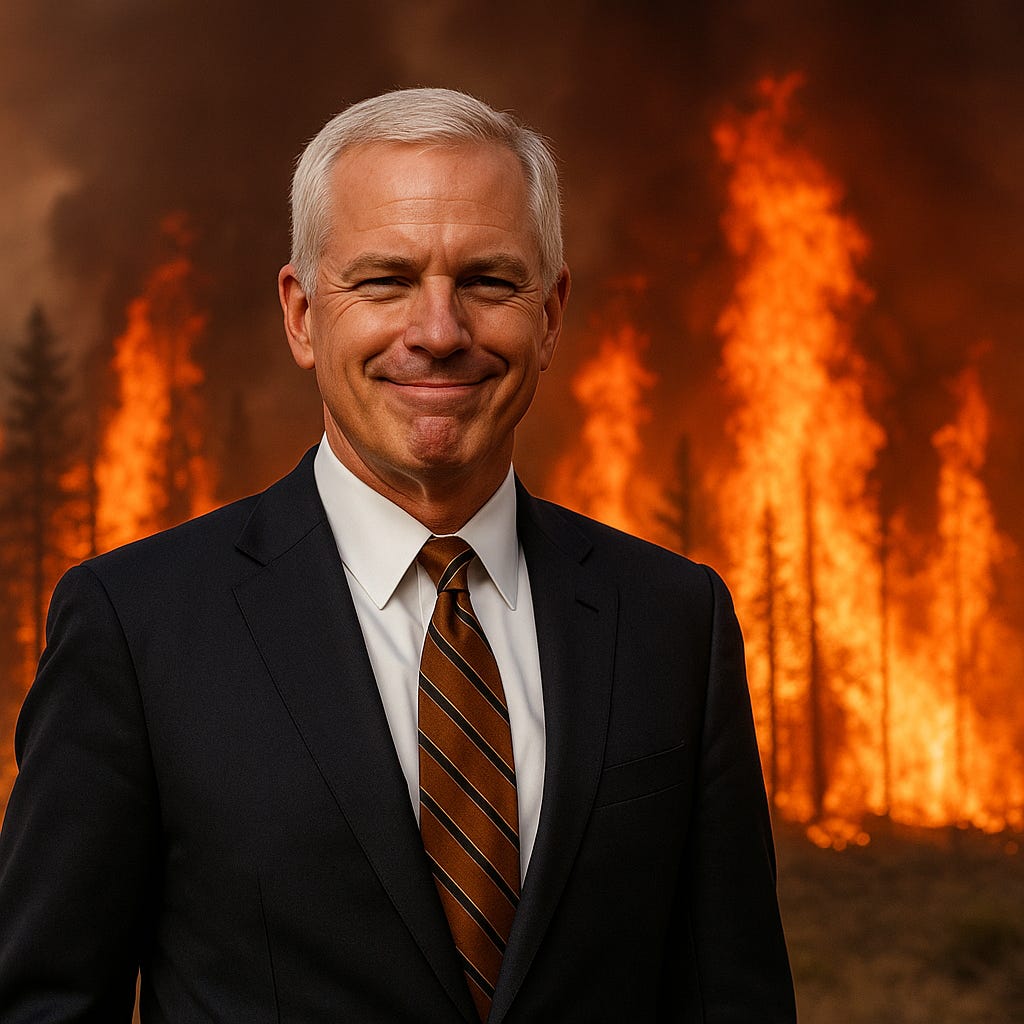

Chubb’s 33% Profit Spike: Wildfire Windfall?

When catastrophe strikes, guess who cashes in.

Let’s not kid ourselves, when disaster strikes, someone always profits. And right now, that someone is Chubb.

Fresh off the California wildfire chaos in Q1, Chubb Insurance just posted a second-quarter profit spike of nearly 33%, clocking in almost $3 billion in net income. You’d think that much catastrophe would burn holes in their books. But no. It padded their profits.

How? Premium hikes.

CEO Evan Greenberg praised “good premium growth and underwriting margin improvement.” Translation? They jacked your rates and blamed the fires.

Here’s the kicker: while property owners scrambled to rebuild, North America personal lines premiums went up 9%,but the combined ratio (that’s how much they paid out vs. what they took in) was just 73.5%. That’s a 10-point improvement from last year, and a galaxy away from the 159.5% disaster they recorded in Q1.

What does that mean in plain English? They collected more, paid less, and smiled all the way to the bank.

Meanwhile, catastrophe losses in Q2 were $510 million after tax, barely more than last year’s $482 million. But it’s pocket change compared to Q1’s $1.3 billion hit. So how’d they rebound so fast? Easy. They raised rates. Especially in wildfire zones. Especially in California.

You got scorched. They got richer.

Chubb’s North American commercial book grew too, up 4.1%, with middle market and small biz leading the way. But here's the quiet part: large account property rates are actually *dropping*. So where’s the growth? Small-town America. The people least likely to fight back.

This is the modern insurance playbook: Use catastrophes to justify premium hikes, even if the actual losses don’t line up. Ride the fear wave. Profit from panic.

And call it “margin improvement.”

—Jack D. Hapsburg