Before FEMA, There Was (Ben) Franklin

🔥 The Fire That Started It All

What the Founding Fathers Can Still Teach Us About Insurance

My trip to Philadelphia was inspiring.

I traced the steps of Benjamin Franklin — laid flowers at his grave, waved at his post office, and made the slow, reverent walk up to the headquarters of the oldest insurance company in the country:

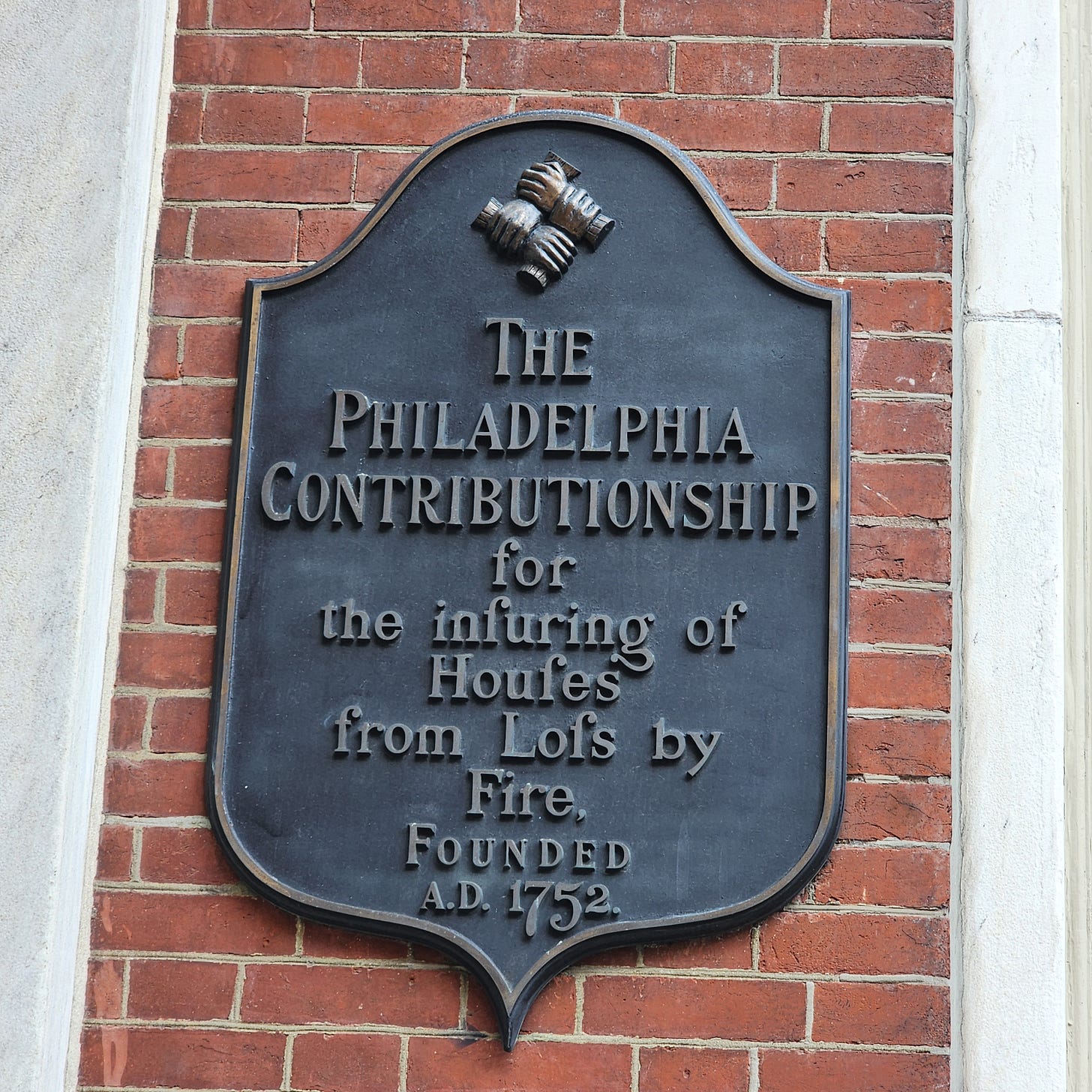

👉 The Philadelphia Contributionship, founded in 1752.

I stood in front of this plaque, mesmerized by the logo; interlocking hands, symbolizing mutual responsibility. Brotherhood. Risk shared, not sold.

And check out that language:

“...for the infuring of Houfes from Lofſ by Fire.”

Call me sentimental, but I’ve got a thing for the King’s English when it’s carved in stone and still rocking the 1752 energy.

But what I love most are the principles this revolutionary institution was built on.

🧱 The Founding Principles of the Philadelphia Contributionship

Ben Franklin wasn’t looking to build a billion-dollar behemoth. He was trying to protect the working class from ruin. These principles? Still fireproof:

Mutual Protection

Every policyholder was a member. No shareholders. No outside profiteers. You paid into the fund, you helped your neighbor, and vice versa.Fire Prevention Was Policy

Inspectors would physically visit your home. If it was risky; say, a wooden chimney or hay stored inside, you were denied coverage.

They weren’t shy about saying “no” to bad bets.Moral Risk Evaluation

No gambling houses. No taverns. No buildings of “loose moral conduct.”

Yeah, they were judgy, but it set the stage for modern-day underwriting.Brick Beats Wood

They insured only brick or stone houses, which helped shape the literal architecture of Philadelphia.Surplus Returns & Community Capital

If there was leftover money after a claim season, guess what? They returned it to members or reinvested it into the fire service.

Not a bonus for a CEO — a bonus for the people.

🧨 Early Claim: The Tannery Fire of 1769

In 1769, a blaze broke out in a neighbor’s shed behind Thomas Wharton’s insured stone home. The flames charred his back wall and torched the shed where he worked leather.

The fire brigade (volunteers with hand pumps) held back the worst of it, but damage was done.

The Contributionship?

✅ Paid out the claim fully, including damages to his leather inventory and tools.

✅ Helped rebuild the workspace, so Wharton’s small business didn’t go under.

✅ Set a precedent; that insurance could work in the New World.

Franklin himself later wrote:

“By this mutual Assurance, the Burden is lightened by many shoulders.”

🪓 CLAIM DUDE TAKEAWAY:

Franklin’s fire company didn’t just fight flames, they sparked a movement.

What they created wasn’t insurance — it was trust infrastructure, built long before we had spreadsheets or reinsurance treaties.

And Inssux?

We’re reviving that flame — same spirit, new armor.

Mutual protection. Transparency. Tools in the hands of the people.

It’s not about fighting insurers. It’s about fixing the model, by remembering how it started.

🔥 Got denied or lowballed on a claim? Good. You just found your people.

📲 Join the Telegram Rebels

🧢 Get your Inssux token

🎥 Watch Jack Hapsburg flip the script