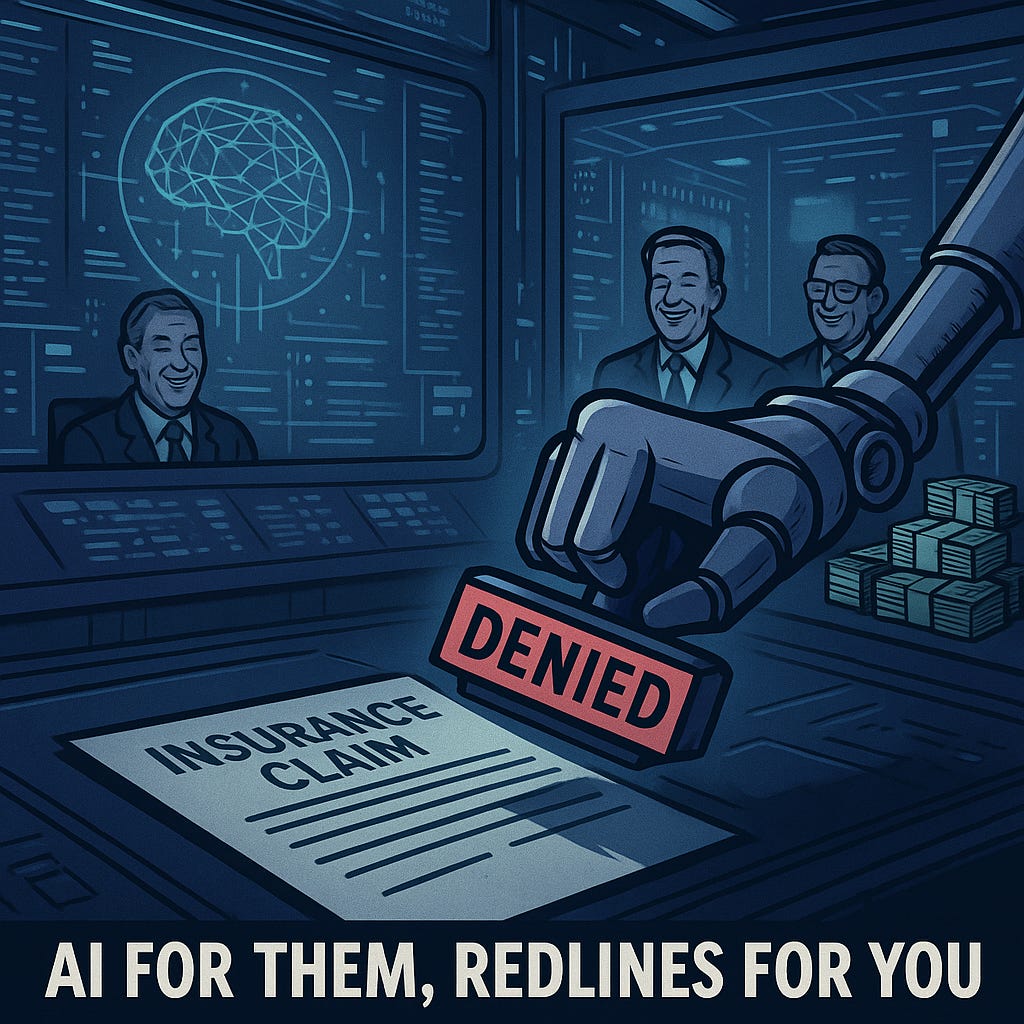

AI for Them, Redlines for You: How Insurers Weaponize Technology

The insurance industry loves to talk about “innovation.” Their latest buzzword? Artificial Intelligence. Applied Systems just scooped up Cytora, an AI firm that promises to “digitize the insurance lifecycle” and make carriers more efficient. Sounds harmless enough—until you realize what efficiency means in this game: faster redlines, quicker exclusions, and more reasons not to pay you.

Let’s cut through the marketing. Insurers aren’t spending millions on AI to help you. They’re doing it to protect their bottom line. Cytora’s software turns submissions, PDFs, emails, and forms into instant data points. That means insurers can scan your risk, reject your coverage, or lowball your claim in seconds, no messy human empathy to slow them down.

They’re selling this as an end to “black holes” in the process, where brokers wait weeks for a quote. But here’s the reality: the black hole isn’t going away, it’s just getting automated. The quote denials will come faster. The exclusions will be sharper. And the machine will never have to look you in the eye when it says “no.”

AI should be a tool for justice, transparency, and fairness. Instead, it’s being hijacked as a digital shield for insurance companies. The same playbook, just updated for the age of algorithms: deny, delay, defend. Only now, the computer does it faster than ever before.

So the next time you hear an insurer brag about their AI platform, remember this: they’re not innovating for you, they’re innovating against you.

That’s why I created INSSUX, to fight “fire with fire”. Join us today and use our FREE tools to punch back.

📢 Call to Action

Got denied or lowballed on a claim? Good. You just found your people.

👉 Join the Telegram Rebels today: @Inssuxdotcom

#️⃣ #MakeThemPay #InsuranceJustice #INSSUX